Solving the Power Bottleneck Scales Access to Space

Shield Capital is investing in mPower's Series B alongside Razor's Edge

Space Has a Power Problem

The defining trend enabling the commercial space economy this past decade was decreased costs of launch. SpaceX’s Falcon-9 and Falcon Heavy have catalyzed new commercial markets and proliferated LEO constellations by reducing these costs up to 80-90%, from $16K/kg to ~$3K/kg. The advent of SpaceX’s Starship, Blue Origin’s New Glenn, Rocket Lab’s Neutron, Stoke Space’s Nova, and others promise to bring these costs down even further.

This increase in supply has been met by a commensurate level of demand, but launch is only one step among many in establishing a robust space economy. Unfortunately, the supply chains supporting these satellites have not kept pace. Key components of the satellite supply chain include satellite bus vehicles, power systems (e.g. solar panels), electrical and wiring systems (e.g. wire harnesses), propulsion systems (e.g. chemical or electric thrusters), guidance systems (e.g. sun trackers), ground support systems (e.g. mission control software and ground stations), and more. Companies like Apex Space, with its modular satellite bus offering, have moved quickly to fill critical gaps in the space supply chain.

Yet many of these bottlenecks persist and are growing. One of the largest is access to solar cells. Nearly every satellite in space depends on these cells, capturing energy from the sun, that power satellite missions and maneuvers. Since the 20th century, these cells have been made of Gallium Arsenide (GaAs), a material well-suited to handle the seemingly tranquil yet harsh environment of space. The industry has long championed GaAs solar panels, notably different from terrestrial silicon (Si) solar panels, because they can withstand radiation in space caused by science fiction sounding phenomena like galactic cosmic rays and solar energetic particles.

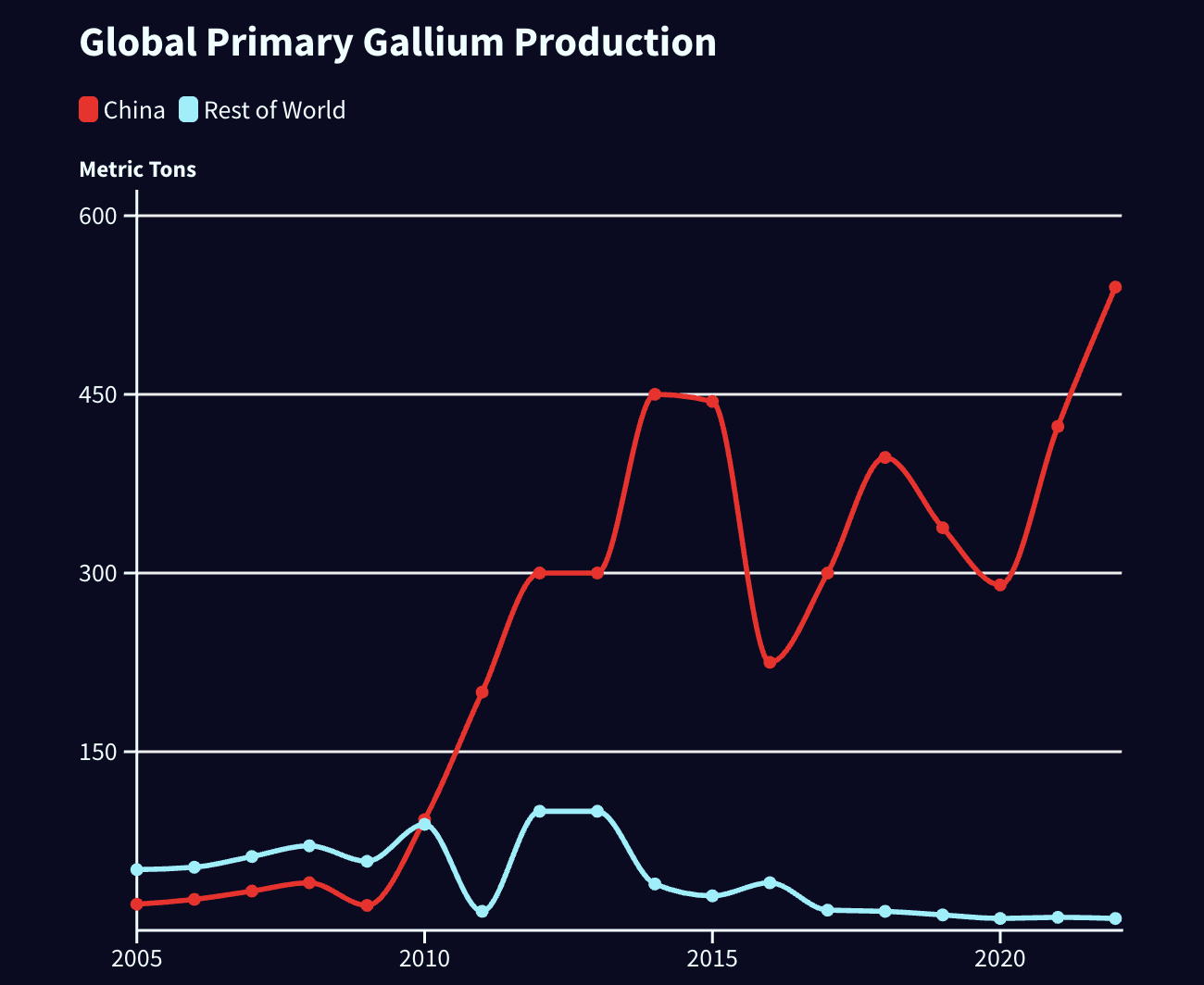

Today, the industry can only produce about 2 Megawatts (MW) of GaAs solar cells per year, enough to cover 10 acres of a solar farm on Earth or power 400 homes. More relevantly, that’s only a fraction of annual demand today – demand that is only growing every year. Concerningly, China produces 98% of the world’s raw supply of Gallium. And further strangling the industry, in December 2024, China banned the export of gallium to the U.S. as part of a larger critical minerals ban. Without the raw materials, we simply cannot make the cells. Moving from GaAs to alternatives is both a commercial and national security imperative.

Source: U.S. Geological Survey via CSIS

mPower Unlocks the Final Frontier

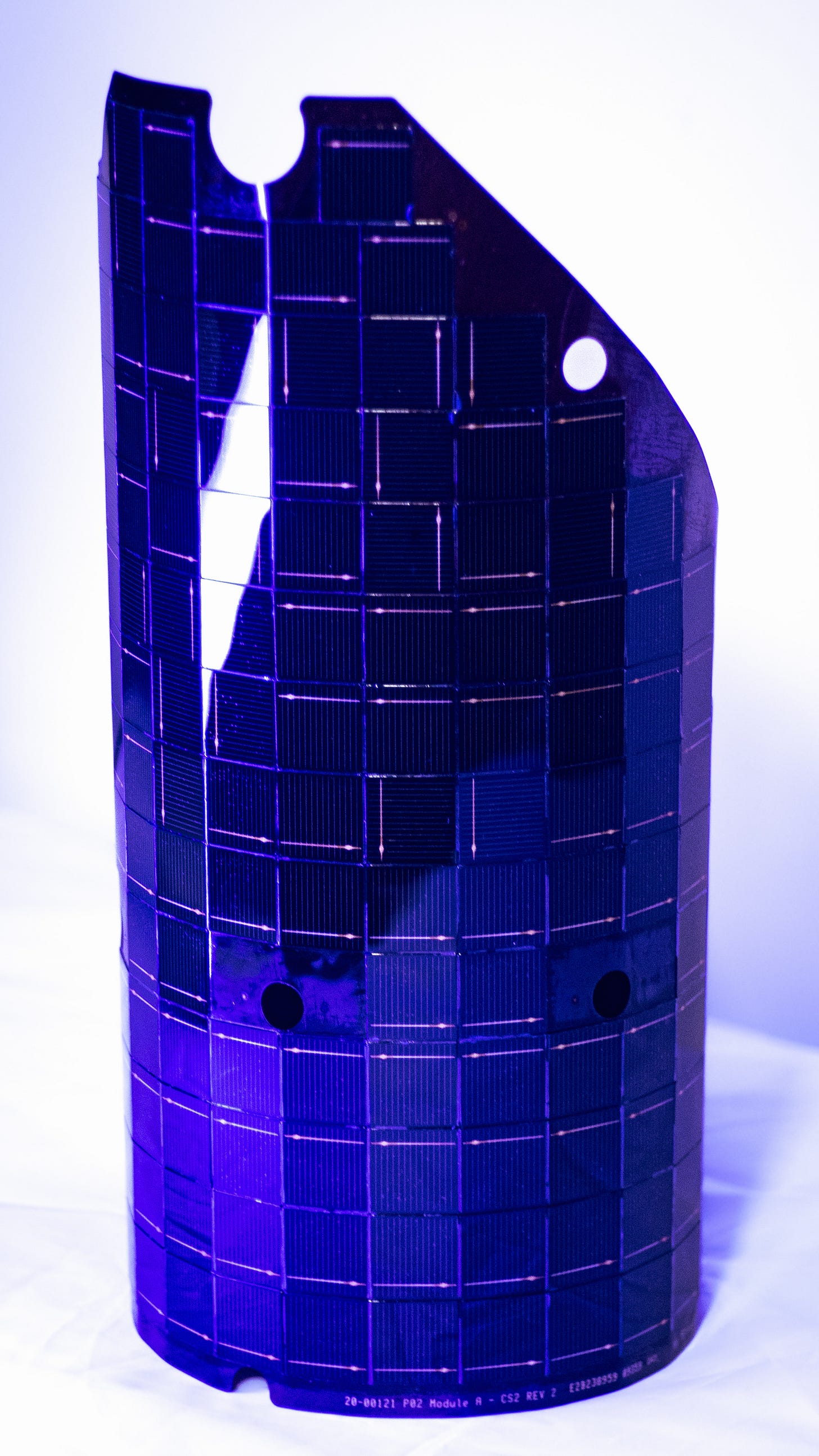

Fortunately, advances in silicon solar cell technology are changing this equation – a trend enabling new entrants like mPower. The leading company developing silicon solar cells, mPower’s proven cells can compete with traditional GaAs cells and provide a domestically produced alternative. Its cells, called DragonSCALES, leverage assembly processes and designs patented at Sandia National Labs and are well suited to target this massive gap in the satellite supply chain. mPower delivers DragonSCALES to its customers leveraging commercial silicon, standard pick & place tools, and proprietary interconnects between cells to limit radiation damage. The price point on a $/W basis for assembled DragonSCALES silicon modules is also lower than that of traditional triple junction Coverglass Interconnected Cells (CIC), the GaAs equivalent, by at least 5x.

Shield Capital believes mPower is poised to lead the future of space power by leveraging several key advantages:

Production Capacity. The limited availability of GaAs – and the risks that China’s recent controls pose to its supply – makes finding alternatives an imperative. While China is the leading producer of silicon, other countries produce it too (the U.S. produces 9% of global supply) and the material is widely used in terrestrial solar modules, making its availability more predictable. Leveraging silicon’s availability, mPower can produce quantities of solar cells that meet customer demands. mPower uses a dedicated manufacturing line at a partner facility that will soon be capable of producing up to 1.5 MW annually, nearly the entire annual capacity of GaAs cells combined. The company can add new manufacturing lines through the same partner in as little as six months. This capacity positions mPower to serve large constellations for both commercial and national security customers in LEO and eventually beyond.

Space Heritage. In the space industry, reliable performance in space is crucial for earning the trust of any customer. mPower’s DragonSCALES have industry-leading reliability, having been deployed on the solar arrays of six different satellites to date. These cells have performed well, cementing mPower’s space heritage and unlocking significant opportunities with customers across the industry.

Team. mPower consists of a highly capable, expert team of complementary leaders. CEO Kevin Hell previously led the licensing business at DivX, a video technology company, and then the whole company as CEO after its IPO, and then ran On-Ramp wireless. He brings unparalleled expertise in scaling hardware businesses. CTO Murat Okandan served as Principal Member of Technical Staff at Sandia National Labs for 15 years, where he developed the solar cell technology that would become DragonSCALES and the relationships within the semiconductor industry that later secured mPower’s key production partnerships.

Today, these advantages translate into a massive opportunity to become the space industry’s leading solar cell provider. The capacity to serve large constellations, the credibility of space heritage, and the execution capability of an expert team give mPower the opportunity to fulfill a massive, unmet need. The company’s recent customer commitments, spanning commercial constellations and national security missions, validate the opportunity.

Powering Our Competitive Edge

The need for power is only growing because space is becoming a more contested domain. Just last month, US Space Force Vice Chief of Space Operations Gen. Guetlein sounded the alarm about recent Chinese “dogfighting” activities in space, satellites demonstrating techniques for combating one another.

These new activities validate Space Force’s founding mission, and they underscore the need for mPower’s solution in two ways. First, the activities defining a contested space environment, including dogfighting, space domain awareness, and rendezvous operations, are particularly power-intensive missions. More than ever, space’s demand for more power capacity will be insatiable.

Second, China’s efforts to contest our space advantage span not only its own in-space capabilities but also its control of the supply chain that enables us to move freely in the final frontier. Growing geopolitical tensions are amplifying the need to deploy more power in space rapidly and, conversely, hampering our ability to do so.

At Shield Capital, we are proud to back the company that is unlocking the future of commercial space and securing America’s advantage at the final frontier.

mPower’s DragonSCALES silicon solar cells